About Us

About Us

Do You Want To Know Us?

About Us

About Us

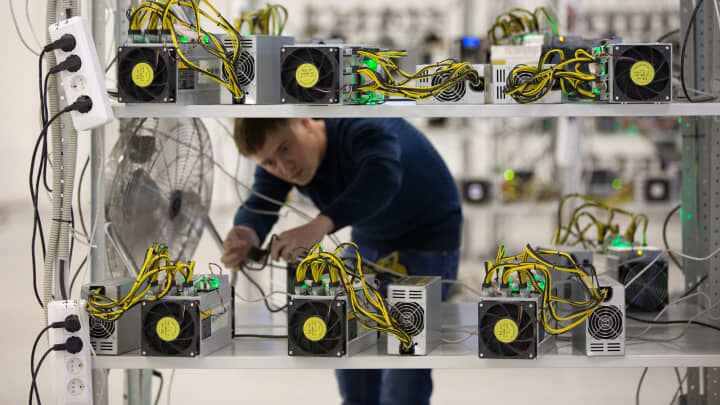

Thinking of moving your farm or looking to exit the mining industry completely, TheMinerMart can help. With our experienced team and our connections, we offer a variety of services to assist with all aspects of relocation including transportation, receiving, and warehousing products, testing and repairing miners, cleaning, packaging and shipping.

It is because we are making mining simple for everyone including you by supplying the needed mining hardware device you are welcome to do business with us.

About us

We Believe in Bitcoin and we are making mining Simple.

TheMinerMart is a Philippine-based ASIC mining hardware and related services, a legit supplier of various mining hardware.

Our experienced team offers a variety of services to help make your mining dreams a reality. Whether you’re looking for procurement services, or maintenance, or need a hand with logistics within your current operation, we are here to help.

Our experienced team offers a variety of services to help make your mining dreams a reality. Whether you’re looking for particular mining hardware, procurement services, or maintenance, or need a hand with logistics within your current operation, we are here to help/assist you.

Currently, the data shows that the all-in-sustaining cost of producing one BTC is $20,000. This is a slightly lower value than the current BTC price, which lingers around $23,554 at the time of writing.

In addition to mining profitability, the chart demonstrates the historical relationship between the all-in-sustaining cost of producing one BTC and the market bottoms. Since 2010, the all-in-sustaining cost of producing one BTC marked a lower value than the BTC price on five different occasions in 2011, 2012, 2018, 2019, and 2021, all of which were followed by an increase in the BTC’s value. Historically, it can be said that this situation might signal a market bottom.

Miner Revenue vs. Yearly Average

The Miner Revenue vs. Yearly Average comparison is used by analysts who want to measure daily volatility against a longer-term trend. This metric takes the total daily revenue generated by BTC miners in U.S. dollars and compares it to the 365-day simple moving average.

The chart below starts from mid-2016 and represents the total revenue paid to miners and the 365-day simple moving average with the orange and blue lines, respectively.